Feie Calculator - An Overview

Wiki Article

The 5-Minute Rule for Feie Calculator

Table of ContentsThe 6-Minute Rule for Feie CalculatorWhat Does Feie Calculator Do?Feie Calculator - QuestionsFacts About Feie Calculator Uncovered9 Simple Techniques For Feie CalculatorThe Definitive Guide for Feie CalculatorThe Ultimate Guide To Feie Calculator

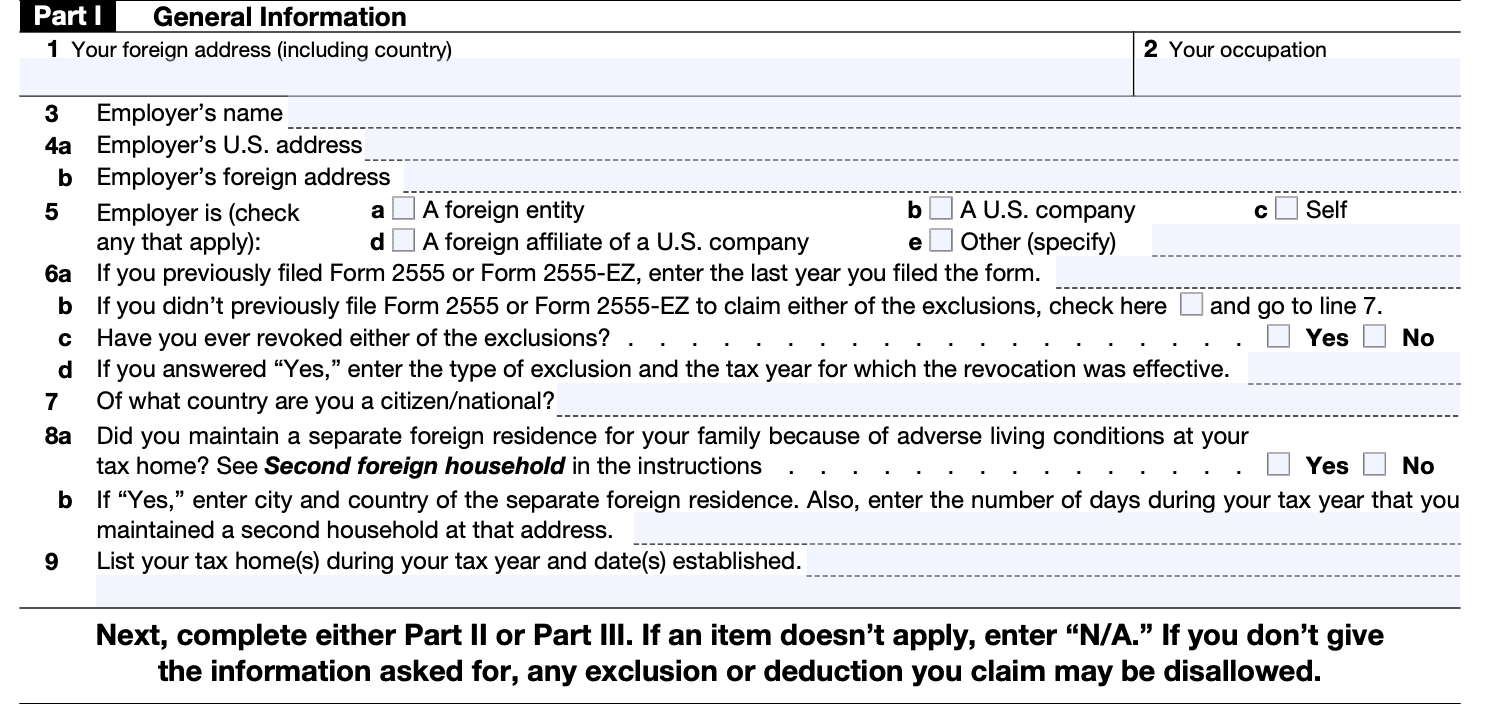

If he 'd often traveled, he would certainly instead finish Component III, listing the 12-month duration he satisfied the Physical Visibility Test and his travel background. Step 3: Reporting Foreign Earnings (Component IV): Mark earned 4,500 per month (54,000 every year).Mark calculates the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his salary (54,000 1.10 = $59,400). Since he lived in Germany all year, the portion of time he resided abroad during the tax is 100% and he goes into $59,400 as his FEIE. Lastly, Mark reports complete incomes on his Kind 1040 and enters the FEIE as an unfavorable amount on Arrange 1, Line 8d, lowering his gross income.

Picking the FEIE when it's not the most effective option: The FEIE may not be optimal if you have a high unearned revenue, earn even more than the exemption limitation, or stay in a high-tax nation where the Foreign Tax Obligation Credit (FTC) might be much more beneficial. The Foreign Tax Credit Report (FTC) is a tax decrease method often utilized combined with the FEIE.

A Biased View of Feie Calculator

deportees to offset their united state tax obligation financial debt with international revenue taxes paid on a dollar-for-dollar reduction basis. This indicates that in high-tax nations, the FTC can typically remove U.S. tax financial obligation totally. The FTC has restrictions on eligible tax obligations and the optimum case quantity: Eligible taxes: Only earnings taxes (or taxes in lieu of income tax obligations) paid to international federal governments are qualified (FEIE calculator).tax liability on your international earnings. If the foreign tax obligations you paid exceed this limitation, the excess foreign tax obligation can usually be carried ahead for up to 10 years or returned one year (through a modified return). Preserving accurate documents of foreign revenue and taxes paid is consequently crucial to calculating the proper FTC and preserving tax obligation conformity.

expatriates to lower their tax liabilities. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can omit up to $130,000 utilizing the FEIE (2025 ). The staying $120,000 might then go through tax, but the U.S. taxpayer can potentially apply the Foreign Tax obligation Credit scores to balance out the tax obligations paid to the foreign country.

Feie Calculator Things To Know Before You Buy

He marketed his U.S. home to establish his intent to live abroad permanently and used for a Mexican residency visa with his spouse to help satisfy the Bona Fide Residency Examination. Neil aims out that purchasing residential property abroad can be testing without first experiencing the area."We'll absolutely be beyond that. Even if we come back to the United States for physician's visits or company telephone calls, I question we'll invest even more than thirty days in the United States in any kind of given 12-month period." Neil highlights the value of strict tracking of U.S. gos to. "It's something that people need to be actually attentive about," he says, and recommends expats to be mindful of usual blunders, such as overstaying in the U.S.

Neil is mindful to anxiety to united state tax authorities that "I'm not conducting any company in Illinois. It's find more information simply a mailing address." Lewis Chessis is a tax advisor on the Harness platform with considerable experience assisting united state residents navigate the often-confusing world of international tax obligation compliance. Among one of the most common false impressions amongst united state

Feie Calculator - An Overview

income tax return. "The Foreign Tax obligation Credit score allows individuals operating in high-tax countries like the UK to offset their U.S. tax obligation liability by the amount they've currently paid in taxes abroad," states Lewis. This guarantees that expats are not strained twice on the exact same revenue. Those in reduced- or no-tax countries, such as the UAE or Singapore, face extra hurdles.

The prospect of reduced living costs can be appealing, however it often includes compromises that aren't promptly evident - https://trello.com/w/feiecalcu. Real estate, for example, can be a lot more economical in some nations, however this can suggest compromising on infrastructure, safety and security, or access to reliable utilities and solutions. Low-cost homes may be located in areas with irregular internet, minimal mass transit, or unreliable health care facilitiesfactors that can substantially impact your day-to-day life

Below are a few of the most frequently asked inquiries regarding the FEIE and other exemptions The International Earned Earnings Exemption (FEIE) allows U.S. taxpayers to omit up to $130,000 of foreign-earned income from federal revenue tax, minimizing their united state tax obligation responsibility. To receive FEIE, you have to fulfill either the Physical Existence Examination (330 days abroad) or the Authentic Home Examination (verify your primary residence in an international country for an entire tax obligation year).

The Physical Presence Test needs you to be outside the united state for 330 days within a 12-month duration. The Physical Presence Test likewise requires united state taxpayers to have both an international earnings and an international tax home. A tax obligation home is defined as your prime area for business or employment, no matter your household's residence. https://www.pageorama.com/?p=feiecalcu.

Some Known Questions About Feie Calculator.

A revenue tax obligation treaty in between the united state and an additional nation can help protect against dual taxes. While the Foreign Earned Income Exclusion reduces gross income, a treaty may provide additional benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Record) is a needed declaring for U.S. people with over $10,000 in foreign economic accounts.

Neil Johnson, CPA, is a tax expert on the Harness system and the owner of The Tax obligation Guy. He has over thirty years of experience and currently focuses on CFO services, equity compensation, copyright taxation, cannabis taxes and separation relevant tax/financial preparation issues. He is a deportee based in Mexico.

The foreign made income exemptions, sometimes referred to as the Sec. 911 exemptions, exclude tax obligation on wages gained from functioning abroad.

The Ultimate Guide To Feie Calculator

The income exemption is currently indexed for rising cost of living. The maximum yearly revenue exclusion is $130,000 for 2025. The tax obligation benefit omits the income from tax obligation at lower tax obligation prices. Formerly, the exclusions "came off the top" minimizing revenue based on tax on top tax obligation prices. The exemptions might or may not lower income used for other objectives, such as individual retirement account limitations, kid credit histories, individual exemptions, etc.These exclusions do not spare the salaries from US taxes but simply offer a tax reduction. Note that a solitary person working abroad for every one of 2025 who earned regarding $145,000 without other revenue will have gross income reduced to absolutely no - efficiently the exact same response as being "free of tax." The exemptions are calculated on a day-to-day basis.

If you participated in service conferences or seminars in the United States while living abroad, income for those days can not be omitted. Your earnings can be paid in the US or abroad. Your company's location or the location where incomes are paid are not factors in getting the exemptions. Physical Presence Test for FEIE. No. For United States tax obligation it does not matter where you keep your funds - you are taxable on your worldwide revenue as an US person.

Report this wiki page